London Wheat Report

Global ags markets were in the red today, with most giving back yesterday’s gains. Soybeans edged down on Wednesday after climbing to their highest point since June 2024 in the previous session after Chinese buying announcements gave the bean market some welly yesterday. Wheat and Corn were trading down in the main session after starting the day positively. A further sale was announced today where USDA Says 330,000 Tons of Soybeans Sold To China In 2025-26 but this couldn’t drive the market upwards.

S&P Global Energy projected, in a note sent to clients, that U.S. farmers would reduce U.S. corn plantings in 2026 by 3.8% compared to 2025 while increasing soybean plantings by 4%.

EU soft wheat exports, which had been lagging due to missing French data, are now matching last year’s volume, European Commission data showed. Since the start of the 2025/26 season in July, EU soft wheat exports had reached 9.05 million metric tons by November 16, compared with 9.09 million at the same point last year.

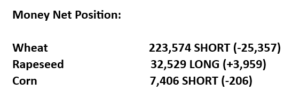

The latest Matif COT traders released this afternoon showed funds adding to their short position in wheat by a further 25K contracts.

Source: ADMISI

Ukraine announced today that it would not restrict exports in 2025/26 July-June season due to a higher harvest and lower export rates at the beginning of the current season. Ukraine harvested 22.6 million tons of wheat in 2024 and exported 15.7 million tons of the commodity in 2024/25. The economy ministry data showed that the country had exported 6.8 million tons of wheat so far this season versus 8.6 million at the same period a season earlier.

There were also rumblings today that there could be a truce in place between Russia and Ukraine before the end of the week, which is something to keep an eye on. Just how much war premium remains in the market is likely to be minimal.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Named to FORTUNE’s Most Admired Company List

January 23, 2026

The Ghost in the Machine Q4 2025

December 22, 2025