Nov 14.25 USDA Report – Neutral/Bearish Corn & Wheat

- Mark Soderberg

- Follow us on Twitter @ADMISI_Ltd

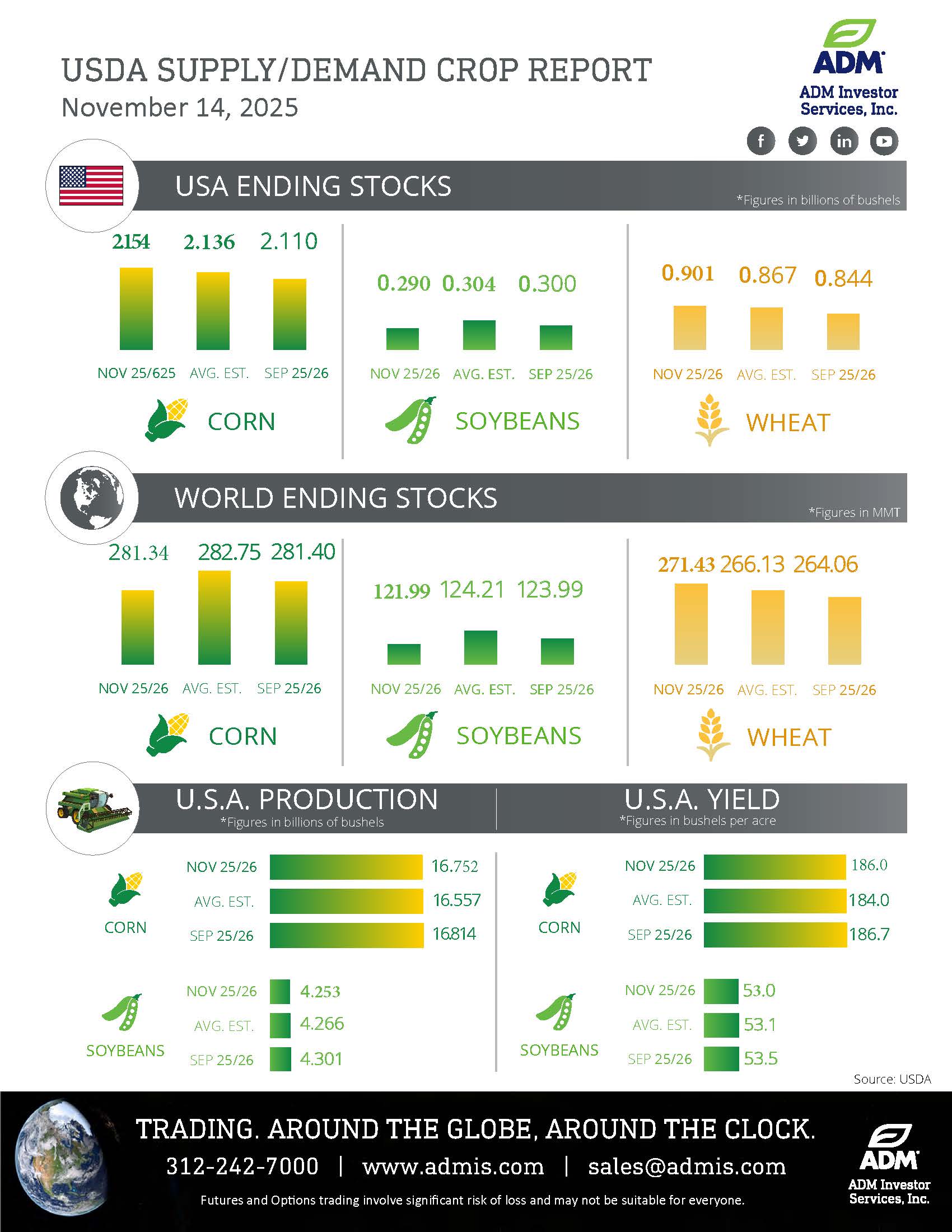

USDA WASDE PRODUCTION HIGHLIGHTS

Relative to expectations today’s data was bearish wheat, neutral to bearish corn, neutral to friendly soybeans however not friendly enough after $1.50 runup from the late summer lows.

Corn:

- US Production cut 62 mil. bu. to 16.752 bil., 195 mil. above expectations

- US yield at record 186 bpa, while down from 186.7 bpa in Sept-25

- Old crop 24/25 feed usage cut sharply raising stocks to 1.532 bil. bu.

- New crop 25/26 demand up 100 mil. bu. on higher exports

- US 25/26 ending stocks at 2.154 bil. were up 44 mil., slightly above expectations

- Brazil’s 24/25 production was increased 5 mmt to 136 mmt.

- Global 25/26 stocks little changed at 281 mmt, slightly below expectations

Soybeans

- US Production cut 48 mil. bu. to 4.253 bil., 13 mil. below expectations

- US yield at record 53 bpa, however down from 53.5 bpa in Sept-25

- Old crop 24/25 crush raised 15 mil. bu. lowering stocks to 316 mil. bu.

- New crop 25/26 demand lowered 51 mil. on lower exports

- US 25/26 ending stocks at 290 mil. were down 10 mil., slightly below expectations

- Brazil’s 24/25 production up 2.5 mmt to 171.5 mmt. No changes to new crop

- Argentine 25/26 exports increased 2.25 to 8.25 mmt.

- Global 25/26 stocks cut 2 mmt to 122 mmt, below expectations of no change

Wheat

- 2025/26 ending stocks increased 57 mil. bu. to 901 mil., 35 mil. above expectations

- Stock increase due to higher production for Sept. 30th, no change in demand

- Global stocks surged 7.3 mmt to 271.4 mmt, well above expectations

- Global production up 12.7 mmt to 829 mmt

- Production increased in Argentina, Australia, Canada, EU, Russia, Kazakhstan and US

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Named to FORTUNE’s Most Admired Company List

January 23, 2026

The Ghost in the Machine Q4 2025

December 22, 2025