MORNING AG OUTLOOK

US government in 36th day of partial shutdown. Senate leaders optimistic about an end but not sure when. Grains are mixed. US stocks are mixed. USD is marginally lower but near season highs. Crude is higher and near $61. Gold is higher. US Supreme Court to hear arguments on Trump tariffs.

SOYBEANS

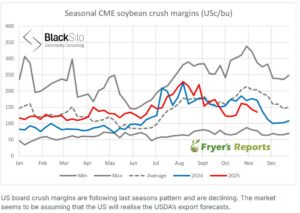

SF is near 11.32. SF-SH narrowed to -13. SX deliveries were 5. ADM stopper. On Nov 14 some feel lower US crop could be matched by lower exports unless USDA is forced to show increase China demand. BOF is near 50 cents. Brazil and Argentina weather remains favorable for crops. China quiet in Brazil. Dalian soybean soymeal lower with negative crush margins, Dalian vegoil lower and near recent lows. S/P Global increased Brazil 24/25 soybean crop 1.5 mmt to 172.0, left 25/26 crop at 178.5.

CORN

CH is near 4.45. US remains competitive to most destinations. Most look for US corn yield near 183 vs StoneX 186 and S/P Global 185.5. Brazil and Argentina weather remains favorable for crops. Increase logistic challenges is slowing Ukraine grain movement to ports. Ukraine exports from July near 1.9 mmt vs 5.15 last year. S/P Global est Brazil 24/25 corn crop up .5 mmt to 141.0, 25/26 up 6 mmt to 145.0. They lowered Argentina 25/26 corn crop 1.5 mmt to 56.5. Some could see US farmer planting 5-7 million less corn acres in 2026.

WHEAT

WH is near 5.60. KWH is near 5.46. KWZ-KWH spread narrowed into -8. MWH is near 5.75. Wheat rallied on rumors of China interest in US white and HRS wheat. Australia and Canada are cheaper. Recent rally in wheat futures has made US wheat exports less competitive. S/P Global increased Argentina wheat crop 1.7 mmt to 23.5 mmt. They increased Russia wheat crop 1.7 mmt to 88.2. They also increased Canada wheat crop 1.5 mmt to 38.7. EU wheat exports are 9.2 mmt or up 6 percent from ly.

Interested in more futures markets? Explore our Market Dashboards here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2025 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

The Ghost in the Machine Q3 2025

October 6, 2025

ADM Exceeds 5M Regenerative Agriculture Acreage Gal

September 9, 2025