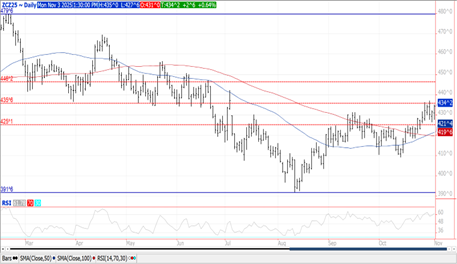

CORN

Prices were $.03-$.04 higher closing near session highs drawing support from another surge in soybean prices. Spreads were steady to slightly weaker. Near term resistance for Dec-25 is at last week’s high at $4.37. Last week’s announced trade deal with China continues to provide support across much of the Ag. space with today’s strength fueled by another wave of speculative buying to kick off the new month. Wire services survey estimates place US corn harvest at 85%, vs. the 5-year Ave. of 82% and 90% from YA. Export inspections at 66 mil. bu. were in line with expectations and above the 57 mil. needed per week to reach the USDA forecast. YTD inspections at 483 mil. are up 64% from YA vs. the USDA forecast of up 5%. Noted buyers were Mexico – 20 mil., Korea with 11 mil. and 8 mil. to Japan. AgRural estimates Brazil’s 1st crop plantings at 60%.

SOYBEANS

Prices were mixed as beans were $.08-$.10 higher closing at session highs, meal was up another $6 while oil dropped nearly a full $.01 lb. Beans spreads were mixed while product spreads were slightly weaker. Jan-26 beans closed into a fresh 13 month high up $1.15 bu. from the August low. Dec-25 oil fell to a 4 ½ month low with next major chart support at 46.55. Dec-25 meal surged to its highest level in nearly 9 months. With the 4 additional cargoes off the PNW, China’s US beans purchases this week are up to 7 cargoes. Total volume is roughly 430k tons or nearly 16 mil. bu. They need to buy just over 33 mil. bu. every week thru the end of Jan-26 to reach 12 mmt. In the past decade, on average China has bought just over 27 mmt of US beans annually. Speculative traders likely stretched their long position in soybeans to over 80k contracts today which would be their largest long position in nearly 2 years. The MM’s short position in meal is likely down to 70k contracts. Combined biodiesel and renewable diesel production plunged 10% in Aug-25 to 378 mil. gallon and is down 17% YOY. Combined biodiesel and RD capacity rose 3.4% to a record 6.964 bil. gallons annually, with all the increase in RD. Bean oil usage for Aug-25 fell 6% to 1.041 bil. lbs. bringing cumulative usage in the first 11 months of the 24/25 MY to 10.626 bil. lbs.

WHEAT

Prices were $.05-$.12 higher across the 3 classes today. Dec-25 CGO and KC both closed above their respective 100 day MA’s for the first time since June. Wire services have reported that China has shown interest in US wheat off the PNW. Estimated volume somewhere in the 250-400k mt range, or about 10-15 mil. bu. Export inspections at 13 mil. bu. were in line with expectations however below the 15 mil. bu. needed per week to reach the USDA forecast. YTD inspections at 434 mil. bu. are up 21% from YA, vs. the USDA forecast of up 9%. After buying 5k contracts of CGO wheat on Friday we still have MM’s net short roughly 75-80k contracts, likely smaller after today’s trade. SovEcon estimates Russia’s production at 87.8 mmt, vs. the Sept-25 USDA est. of 85 mmt. They also raised their export forecast .4 mmt to 43.8 mmt, vs. the USDA est. of 45 mmt. Wire services are reporting US winter wheat plantings have likely reached 92%, up from LW’s estimate at 85% and just above YA at 87%. Crop ratings are believed to have improved 2% to 52% G/E.

Charts provided by QST.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2025 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Exceeds 5M Regenerative Agriculture Acreage Gal

September 9, 2025

ADM Reports Q2 2025 Results

August 5, 2025