London Wheat Report

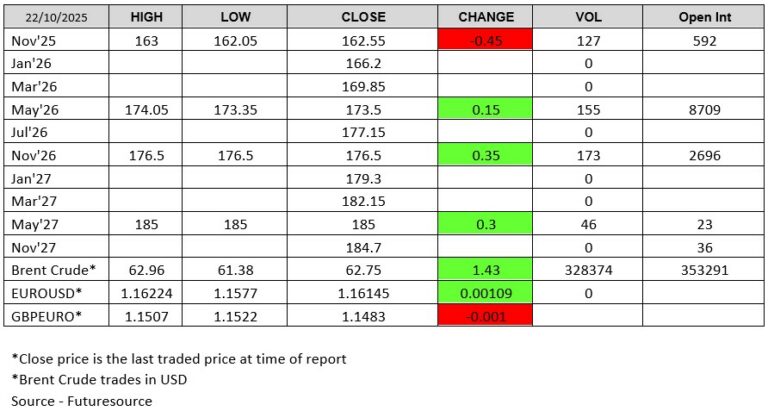

As we approach first notice day on Nov25 London wheat (27.10.25), with OI expected to be 465 after today’s 127 lots went through, is the pressure on the long or the short? Will we see a decent tender or will this OI go to zero? It will be interesting to see what happens to Nov25 price and the Nov25/May25 spread over the next two sessions.

Matif Dec25/Mar26 continues to tighten, settling at -1.75 we are keeping a close eye on this with memory of the Sept25/Dec25 going to a reasonable premium.

Fresh news is limited as the partial Fed. Govt. shutdown is now in its 4th week.

Pres. Trump maintains he plans on meeting with Chinese leader Xi in less than 2 weeks with hopes of further advancing trade talks while US trade representative Greer and Treasury Sec. Bessent travel to Malaysia to meet with Chinese trade officials this weekend. Yesterday the Trump Admin announced they would reopen the FSA portion of the USDA while also distributing $3 bil. in aid to farmers hurt by China’s boycott of American soybeans. The Administration continues to hint at a larger aid package funded by US tariff revenues, however, work here is on hold with the partial Fed. Shutdown.

Spot crude oil is up $1.40 per barrel after EIA data showed US inventories fell nearly 1 mil. barrels vs. expectations for a 1.3 mil. barrel build.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Named to FORTUNE’s Most Admired Company List

January 23, 2026

The Ghost in the Machine Q4 2025

December 22, 2025