CORN

Prices were $.03-$.04 lower ahead of what will likely be an active harvest weekend. Spreads also eased. Dec-25 is back below its 100 day MA closing at about the midpoint of this week’s $.10 range. Argentine corn plantings have doubled in the past week from 6% to 12%. France’s corn harvest advanced 9% LW to 14%, in line with the 5-year Ave. however well above the 1% pace from YA. My estimate for Sept. 1st corn stocks at 1.344 bil. bu. is 19 mil. above the USDA forecast in the Sept-25 WASDE and slightly above the Ave. trade guess. Yesterday’s Hog and Pig report showed US inventories at 98.7% of YA, vs. expectations of 100.3%. IMO current price levels are discounting US yields 2-3 bpa below the USDA record forecast at 187.6 bpa.

SOYBEANS

Prices were quietly mixed with beans up $.01-$.02, meal was steady to $2 higher while oil was off 5 – 10 points. Bean and oil spreads were mixed, while meal spreads weakened with some making new lows. Following Monday’s break, Nov-25 beans spent the rest of the week consolidating between $10.05 and $10.20. Oct-25 oil once again couldn’t hold strength above $.50 lbs. Inside trade for Oct-25 meal as it held support above its CL at $266.10. Spot board crush margins held steady near a 3 month low at $1.42 bu. with bean oil PV slipping to 47.7%. Census crush data after the close next Tues. While US farm groups urge Pres. Trump to prioritize a trade deal with China, his administration seems more fixated on provided financial assistance to struggling farmers. Trump stated his administration would use tariff revenue to fund an aid package for US farmers, a move that seems risky given the US Supreme Court this fall will hear arguments on the legality of the Trump Administrations use of tariffs. China wasn’t the only active buyer of Argentine Ag. Goods this week as India reportedly bought 300k mt of soybean oil during the 2 day period. Analysts expect India will import a record 17.1 mmt of vegetable oil in the 25/26 MY, up 4.6% YOY. Palm oil exports are expected to jump 13.4% to 9.3 mmt, bean oil imports at 5 mmt would be down 2% YOY while sunflower oil imports are pegged at 2.7 mmt, down 10. This afternoon’s CFTC report is expected to show MM’s flip their soybean position to net short 20-25k contracts. MM’s are also thought to have extended their short meal position to 93-95k while their long position in oil is expected to be around 5k contract’s.

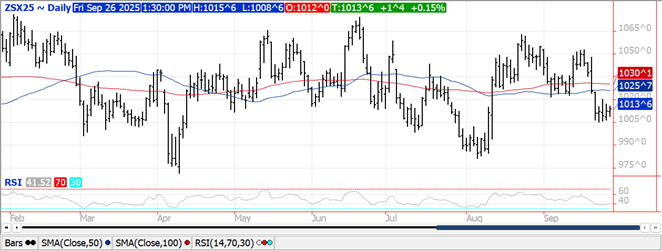

WHEAT

Prices ranged from $.05-$.07 lower across the 3 classes. Dec-25 KC and CGO both rejected trade above yesterday’s highs overnight. The moderate short covering bounce ahead of month and quarter end may have run its course. Estimates for next Tues. Annual Small Grain Summary expect a very modest cut to this year US wheat production. This AM SovEcon lowered their Russian export forecast by .7% to 43.4 mmt, following a slow start to their 25/26 export program which was down 29% in the July thru Sept timeframe. The USDA Russian export forecast rests at 45 mmt.

Charts provided by QST.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2025 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.