London Wheat Report

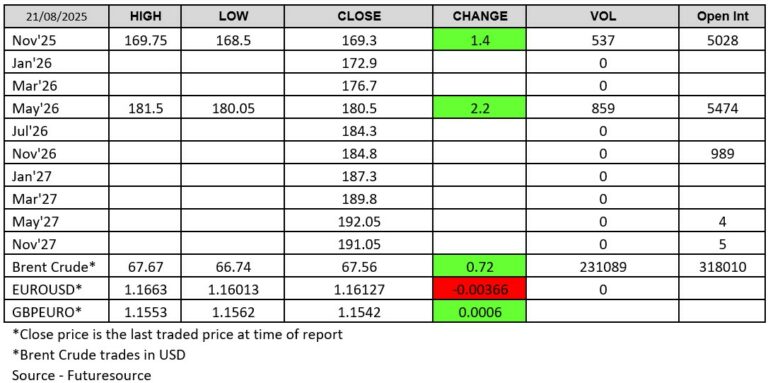

Day three of the London wheat spread seeing good volume; once again the Nov-25/May-26 spread is supporting volume through both contracts on screen. Prices ended the day once again in the green on London wheat following Chicago wheat’s continued rally that started yesterday. Matif wheat also ended the day in the green, whilst Chicago appeared to run out of steam, the upside limited by a stronger USD.

It was announced today that the International Grains Council (IGC) has raised its forecast for 2025/26 global corn production, largely reflecting an improved outlook for the U.S. crop. The IGC, in its monthly update, projected the global corn crop would reach a record 1.299 billion tonnes, up 23 mmt from its previous estimate. The U.S. corn crop was seen at 423.5 million tonnes, up from a previous projection of 398.9 million. This news did little to stop the CBOT corn contract from spending most of the day in the green. This can be seen owing to expectations of an increase in global consumption forecasted for the near future.

Reports from an annual crop tour of the Midwest today announced that corn yield potential and soybean prospects are significantly above average across Illinois and Western Iowa, though plant diseases could threaten final yields. Timely rains benefited crops in western Iowa but also promoted the growth of fungal diseases such as southern rust in corn and sudden death syndrome in soybeans, which tend to lower crop yields.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Ryan Easterbrook, Aaron Stockley-Isted and Jamie Kirkwood

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Named to FORTUNE’s Most Admired Company List

January 23, 2026

The Ghost in the Machine Q4 2025

December 22, 2025