London Wheat Report

The lower cost of growing soy versus corn, floods in some areas and a quick winter wheat harvest drove the U.S. government to raise its soybean production forecast to a record high this week, farmers and analysts said. A record harvest from the world’s second-biggest soybean producer would contribute to larger supplies of the oilseed, used to make biofuels and livestock feed. Global grains markets are in oversupply after several years of disruption and tight supplies due to the pandemic and then the war in Ukraine. Large corn and soy crops globally, as well as feeble demand from exporters and domestic processors, have driven prices to near four-year lows and led to a rapid decline in U.S. farm income forecasts this year.

The International Grains Council (IGC) has trimmed its forecast for 2024/25 global wheat production driven largely by a downward revision for France which has just endured one of the worst wheat harvests in decades. The inter-governmental body, in its monthly update on Thursday, forecast global wheat output at 799 million metric tons, down from a previous projection of 801 million although still above the prior season’s 794 million. France’s wheat crop was put at 27.5 million tons, down from 31.0 million seen previously and sharply below the prior season’s 36.3 million.

SovEcon have also cut Russian wheat crop production by 1.8 million metric tons (MMT) to 82.9 MMT. The new forecast reflects Rosstat’s lower estimate of planted areas and a decrease in yields in several regions. Rosstat estimated the wheat planted area at 28.5 million hectares (mln ha), compared to 29.8 mln ha the previous year and SovEcon’s estimate of 29.2 mln ha.

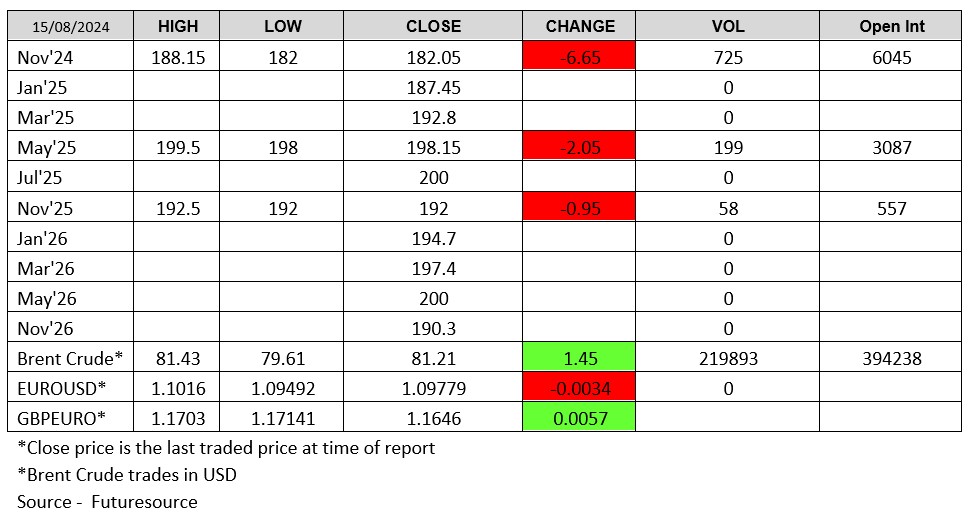

With the above news, it would be safe to say the market should have found support, it didn’t. Down down down is the mood of the day. Both Matif and London were trading well down at the close of play. London had a decent day for volume with over 700 lots crossing the line across the curve. Nov May spread traded out to £15 today. 55 lots traded on that spread between £12 and £15. November was trading at £182 down a whopping £6.65 in the red.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Ryan Easterbrook, Aaron Stockley-Isted and Jamie Kirkwood

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Named to FORTUNE’s Most Admired Company List

January 23, 2026

The Ghost in the Machine Q4 2025

December 22, 2025