London Wheat Report

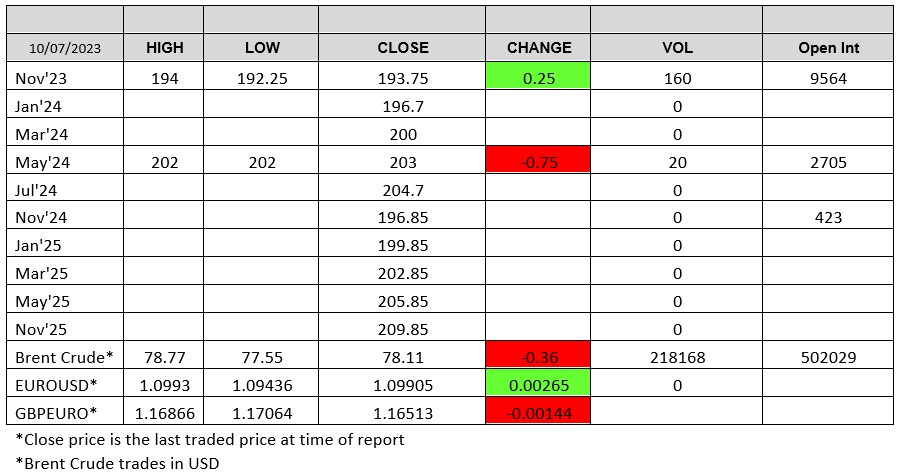

Source: FutureSource

Happy Monday all!

Well, Joe Biden is in the UK today pre Nato summit, having had tea with King Charles today. BOE keeps up their chatter that UK inflation is set to fall ‘markedly’ – by end of the year is the promise although this really will have to be seen to be believed. Thames have had a £750m cash injection. F1 was a decent race yesterday for those of you that follow and England remain in the cricket.

Not tremendously exciting today by all accounts. US weekly wheat inspections have increased by 22% to 419kt to July 6th. Russian exporters have fired up the new exporting year with a reported 1Mmt moved out – a reported 1.265Mmt shown from Russian ports. Ukraine continue to invest in new terminals along the Danube with chatter that they could, very big could, export circa 20Mmt down the Danube – think there are more elements to win over the guys in Constanta than the dredging elements to service larger draft. The French soft wheat harvest was around 14% complete last week versus the 5% on the previous. This is a change from the previous harvest by 1% reflecting the early started to field work after hot and dry weather in the late springtime. UK barley harvest is underway pretty well from all accounts in the south and central UK. Matif wheat was trading marginally lower today with decent volumes and London was trading around unchanged levels for most of the day on Nov-23. Vols weren’t too drastic.

US corn was trading up today. The trade is looking for a 1 to 3% increase in the G/Ex rating today and also weather is showing some beneficial precipitation moving across. CFTC shows that managed money also flipped over to a net short after jettisoning long positions. US weekly corn inspections were down 50% to 341,024t. Soybeans were supported on trade expectations of a major cut in US soybean stocks. Matif rapeseed remained supported in today’s trade.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Named to FORTUNE’s Most Admired Company List

January 23, 2026

The Ghost in the Machine Q4 2025

December 22, 2025