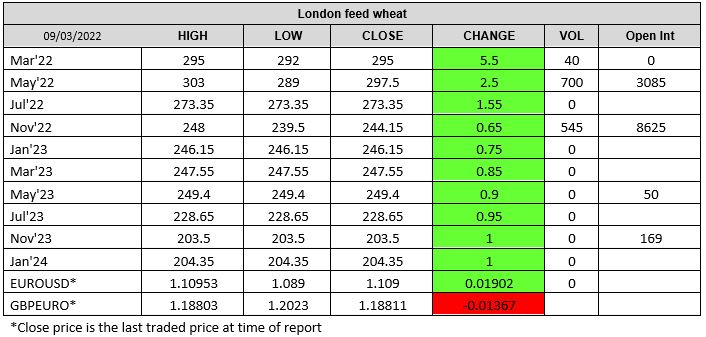

London Wheat Report

Source: FutureSource

WASDE day. 2021/22 US wheat supply and demand is for lower supplies and unchanged domestic use, reduced exports and higher ending stocks. Exports reduced by 10m bushels. Global outlook this month is for decreased trade and consumption, higher production and larger ending stocks. Global outlook is raised on the back of a cracking Aussie crop where ABARES estimate raised production 2.3Mmt to a record 36.3Mmt (Toyota Land Cruiser sales are going to be popping if they can get around the semiconductor shortage). World exports are lowered by 3.6Mmt to 203.1Mmt as decreases for Ukraine and Russia are only partly offset by increases for Australia and India. Exports lowered for Ukraine by 4Mmt to 20Mmt as the conflict continues. Russian exports are reduced 3Mmt to 32Mmt as vessel transportation is expected to be constrained by the conflict and the associated economic sanctions. Partly offsetting these reductions are increases to the Aussie and Indian exports. Increased production and competitive prices are expected to boost Aussie exports to a record level. 2021/22 global use forecast is lowered to 0.8Mmt to 787.3Mmt. Global ending stocks are raised 3.3Mmt to 281.5Mmt.

Russia are due to announce which commodities they will be placing under an ‘export ban’ in retaliation for Western sanctions – wheat is rumoured to be one of them although this has not yet been confirmed. Putin agreed to open the Azov for 30 vessels to outload with wheat and sun oil to be shipped to Turkey. Expect more of these deals to ‘friendlier with Russia’ nations. Bulgaria announced that it will be buying $617m of wheat to boost state reserves. Algeria has also believed to not have purchased any grain in its tender from yesterday. Matif wheat settled May-22 settled up €2.25 at €372.25/t.

2021/22 US corn supply and use outlook is for increased

food, seed and industrial use, larger exports and smaller stocks relative to

last month. Global corn production forecast is for larger production, lower

trade and greater ending stocks relative to last month. Increased production is

raised for India ad Russia that are partly offset by declines for Argentina and

South Africa. Corn exports are raised for US and India but reduced for Ukraine.

Tighter oilseed supplies and high oilseed meal and vegetable

oil prices reduce forecasts for global demand growth. Global 2021/22 soybean

trade is educed 6.4Mmt to 158.6Mmt with lower exports for South America that

are partly offset by higher US exports. Global soybean stocks are lowered

2.9Mmt to 90Mmt, lowest level since 2015/2016. Matif May-22 rapeseed settled up

€8.25 at €891/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2022 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Named to FORTUNE’s Most Admired Company List

January 23, 2026

The Ghost in the Machine Q4 2025

December 22, 2025