London Wheat Report

Source: FutureSource

Volatility reaches ridiculous levels. Brent crude hit a trading high at time of writing of $113.94/ba today before pulling back marginally. Chicago wheat hit the extended limits again. Global awareness of the gravity of cutting resource rich Russian exports is becoming a harsh reality. White House economic advisor, Ramamurti, says that they do not want to go after Russian Oil and Gas right now as he believes it could raise global prices ….. think we are already at unprecedented prices on markets now. Fertiliser prices around the globe are jumping with availability declining. China has started beating the drums to ensure state owned agencies are covered for energy and commodity supplies to ensure power and stability. Continued talks are on the table between Russia and Ukraine later this evening and Russian artillery continues to bombard southern Ukrainian towns.

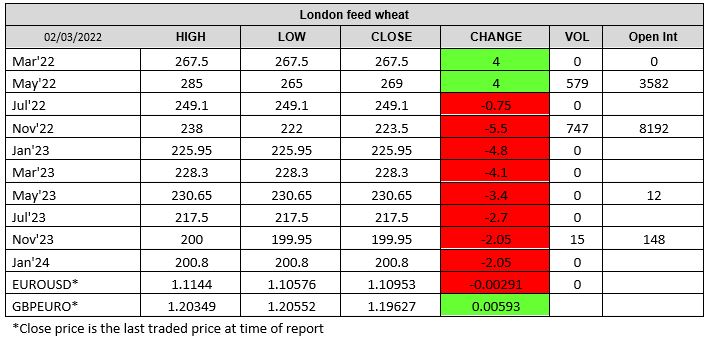

Wheat markets saw some serious volatility in today’s trading. Chicago wheat hit upper limit of 1059 before a mid-morning liquidation where it was trading unchanged before hitting the upper limit once again. Matif milling wheat Mar-22 followed, hitting a trading high of €390/t shortly after opening before hitting a trading low of €349.75 when Chicago liquidated before settling up €9.75 on yesterday at €361/t. May-22 hit a trading high of €371.25/t and a trading low of €330.50/t before settling up €0.50 on yesterday at €340.75/t. Crazy. London wheat May found support and Nov settled down. Jordan did not have any market participants in it 120kt tender and Turkey started purchases for its 435kt, purchasing an initial 75kt. Price to be confirmed. North African wheat buyers were reported to be mulling Argentinian wheat imports.

USDA reported 364kt of soybeans to unknown and 266kt of

Soybeans to China. Malaysian palm continues to make new highs. Matif rapeseed

saw May-22 settle down €22 on yesterday at €803.75 and Aug-22 settled up €3 at

€711.50/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2022 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Named to FORTUNE’s Most Admired Company List

January 23, 2026

The Ghost in the Machine Q4 2025

December 22, 2025