London Wheat Report

Source: FutureSource

Over the weekend, Putin’s forces continue to push into Ukraine with heavier weaponry being unleashed upon Kharkiv today according to the news channels. Ukrainian and Russian delegation met on the Belarusian border today for talks, not much seems to have been achieved unsurprisingly. Russian banks have been cut off from SWIFT over the weekend and countries all over the western world are cracking on with sanctions against Russia. The Rouble had an absolute hammering when markets opened today while precious metals and ags have rallied significantly overnight. Currently the debate is how long Black Sea exporters are out of business is the major trading point.

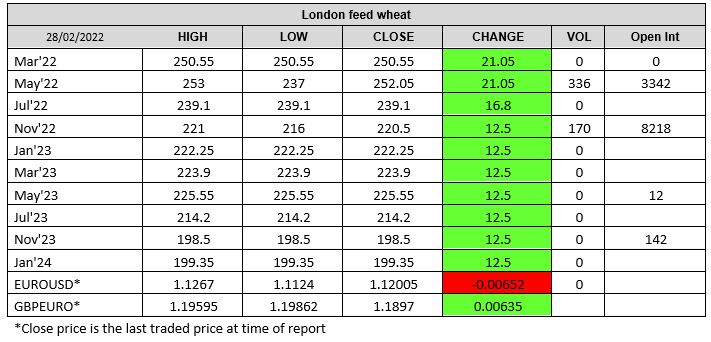

GASC decided to cancel their latest tender after receiving the lowest offer from French sourced wheat at $389.82/t FOB. An unusual offer of wheat sourced from the US was also submitted but the French offers were $80/t lower to Houston HRW from Cargill. Last year, Egypt imported nearly 70% of its wheat needs from Russia in 2012. Wheat markets continued to find support in both the US and Europe. There are fears that the fighting will not be over quickly and that wheat, grain and oilseed export shipments from Ukraine will face disruption for a longer period than initially expected. Ukraine’s ports are also to stay closed until the Russian invasion ends according to the head of Ukraine’s Maritime Administration. Russian exports now face a raft of issues due to international sanctions which include commodity finance issues after SocGen and Credit Suisse Group halted the finance of commodities trading from Russia. Matif May-22 settled up €25.75 on Friday at €315.50/t. London wheat followed markets higher with May-22 hitting a trading high of £253/t today.

Brent crude was trading up again today, hitting over $100/ba. USDA reported 136kt of new crop beans sold to China with another 120kt of old crop sold to unknown. Beans are finding considerable support by a vegoil market that is panicking, as we saw Malaysian Palm oil make its largest single move higher overnight. Supply concern over a dry Central Brazil which may give another sluggish start to some Safrina. Matif rapeseed pushed higher with May-22 settling up €28.50 on Friday at €755.50/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2022 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Named to FORTUNE’s Most Admired Company List

January 23, 2026

The Ghost in the Machine Q4 2025

December 22, 2025