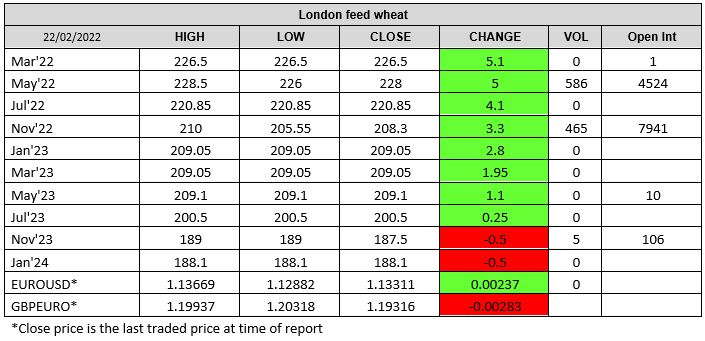

London Wheat Report

Source: FutureSource

Market volatility continues over the Russia/Ukraine saga in the Donbas. After last night’s news that Russia now legally recognise the territories of Luhansk and Donetsk as part of Russia, markets got excited. There have been headlines throughout the day of a few explosions and shelling alongside Russia’s Upper House of parliament voting in favour of giving Putin formal authority to deploy Russia’s armed forces. Western world still attempting to exhaust all diplomacy options and the odds on an all-out war still remain low but that tanks are now in downtown Donetsk. Chicago wheat was trading higher. Matif wheat opened the session higher with Mar-22 hitting a trading high of €282.75/t just after the market opens before cooling off and settling up €4.50 on yesterday at €278.50/t. If further incursions occur, global grain and oilseed markets will jump.

Oil markets also jumped up this morning, with Brent hitting $99.50/ba this morning, the highest price since September 2014. Malaysian palm oil also jumped to an all-time high for the contract. Matif rapeseed continued to gain support from this with May-22 settling up €13.50 on yesterday at €729.50/t.

132kt of new crop soybeans sold to China today according to

the USDA. Soybeans are finding support from oil and bean oil. Chicago Mar-22

were trading up 24 cents at $16.25 at time of writing. Chicago March soybean

highs overnight came within a penny of the Feb-10 highs which for now could

look like a double top. South American drought story seems to be getting exhausted

to the upside with private analysts now refraining from making additional cuts

to the crop. Brazilian farmers aren’t selling as heavily as some would have

anticipated. Weather is dry for most of Southern Brazil this week. ADM

also set the record for the largest single soybean shipment from the Ponta de

Montanha Grain Terminal, northern Brazil, shipping 84,802kt in a single vessel

headed to Rotterdam. This beat the previous record of 82,531kt.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2022 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Named to FORTUNE’s Most Admired Company List

January 23, 2026

The Ghost in the Machine Q4 2025

December 22, 2025