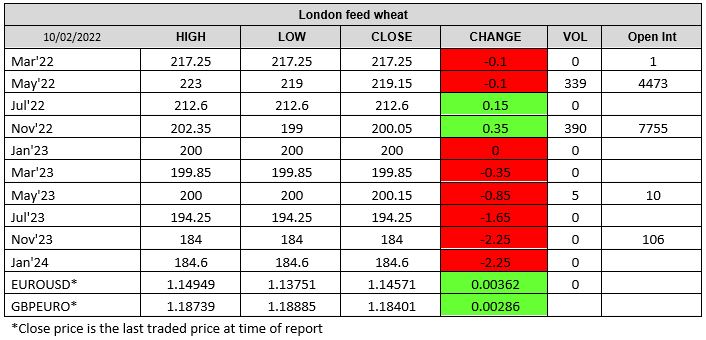

London Wheat Report

Source: FutureSource

A seriously volatile day on the ag markets today. Chicago soybeans started seriously gunning it this morning, hitting 9 month highs on the back of a sharp cut to Brail’s official harvest forecast fanned concerns about weather damage to South American crops. Conab’s figures really supercharged beans earlier today, enabling Mar-22 Chicago to hit a trading high of $16.33 at time of writing before coming back down to circa $15.95 at time of writing. USDA also reported bean sales of just under 300kt today. Conab set Brazilian production levels at 125.5Mmt, on par with private estimates and down 15Mmt from Jan. This is in comparison to the USDA’s 134Mmt yesterday. Private analysts still believe that further cuts are due with the prevailing issues in Argentina continuing. US soybean export sales are also leaning supportive. Matif rapeseed also found support from the soybean surge, combined with strong palm oil and Brent Crude. Matif May-22 settled up €3.50 on yesterday at €686.25/t.

Corn also reached its highest point since June, with Chicago corn Mar-22 hitting trading highs at time of writing of $6.6275 before cooling off but still trading around circa $6.50 at time of writing. Dryness in Brazil and Argentina was once again the prevailing factor. Confirmation of Chinese corn interest that was rumoured yesterday would really light a serious fuse that hasn’t been touched for a while. If this is true, hope the US export terminals are ready for some serious out loading.

Matif wheat took off today’s trading, with Mar-22 hitting highs of €271.25 today after the market reacted as Ukrainian news channels started chatting about potential disruption of commercial traffic from Russian naval exercises in the Black Sea and Azov sea. Slightly over the top in reality, with news agencies citing ‘the presence of warships had made navigation in the Black Sea and Azov Sea virtually impossible’. This caused a substantial sway in the market. France’s farm ministry also lowered its estimate of the area sown with winter soft wheat for the 2022 harvest to 4.75 mln ha from 4.92 mln ha in its initial December projection. This reduced estimate was down 4.3% compared to the 2021 harvest. Matif Mar-22 wheat settled down €1.25 on yesterday at €261.50/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2022 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Named to FORTUNE’s Most Admired Company List

January 23, 2026

The Ghost in the Machine Q4 2025

December 22, 2025