London Wheat Report

Source: FutureSource

WASDE day today. Wheat outlook for 2021/22 US wheat this month is for lower supplies, higher domestic use, reduced exports and slightly higher ending stocks. Supplies reduced on lower anticipated imports. Total domestic use is projected at 2Mbu higher. Exports are lowered by 15Mbu. Projected 21/22 season-average farm price is raised $0.2 per bushel to $6.90 by the NASS. Global wheat outlook 2021/22 is for reduced supplies, slightly higher consumption, increased trade and lower ending stocks. Supplies projected down 1Mmt to 1,063.2Mmt based on decreases in beginning stocks and production. World production lowered 0.6Mmt to 775.3Mmt due to decreases in EU, UK and Uzbekistan offset increase in Russia. Russian wheat is raised to 74.5Mmt. World consumption is raised 0.4Mmt to 787.2Mmt. Projected global ending stocks are down 1.4Mmt to 275.8Mmt. Chicago Dec-21 was trading up 6 cents and Kansas Dec-21 was trading up 7 cents at time of writing.

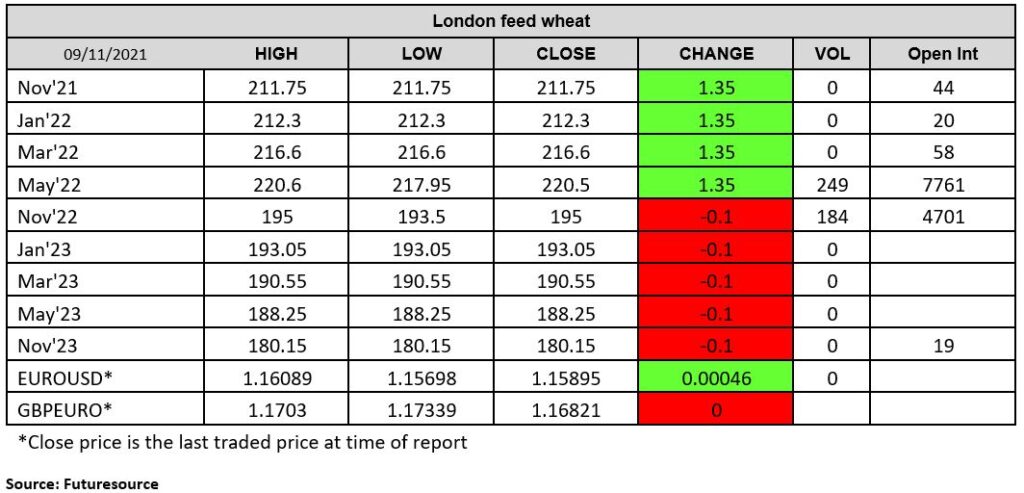

Matif wheat settled up on the bullish US wheat sentiment. Matif Dec-21 settled up €2.25 at €286/t and Mar-22 settled up €2.50 at €281.50/t. French farm ministry raised its estimate today for 2021 soft wheat production in France to 35.5Mmt from the 35.2Mmt projected last month. Wheat tenders continue with the UN issuing a 110kt tender to supply wheat to Ethiopia and the Ethiopian government tender for 300kt closing today. London wheat settled mixed with May-22 settling up £1.35 on yesterday at £220.50/t and Nov-22 settling down £0.10 on yesterday at £195.00.

US Corn outlook for 2021/22 is for greater production with increased use for ethanol and marginally lower ending stocks. Corn production is forecast up 43Mbu. Corn use in ethanol is raised 50Mbu. Global corn production is forecast 5.1Mmt higher to 1,499Mmt. Increased corn production for Argentina, EU and several African counties offset the Philippines. EU increases are in Poland, Romania and France. Corn imports are raised for Iran and Thailand but lowered for Nigeria and Turkey. Global corn ending stocks at 304.4Mmt, up 2.7mmt. Chicago Dec-21 corn was trading up 3 cents and Matif Mar-22 settled up €0.50 on yesterday at €235.50/t.

USDA surprise on lower bean yield and production. Outlook 2021/22 is for lower production and exports combined with higher ending stocks. US Soybean production has been downgraded by 23Mbu on lower yields. Global soybean production is reduced 1.1Mmt to 384Mmt as lower US and Argentine production is partly offset by higher Indian production. Chicago Jan-22 soybeans were trading up 25 cents at time of writing. Matif Feb-22 rapeseed settled up €14.25 on yesterday due to the rally on Soybeans in Chicago settling at €692.75/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston, Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2025 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

The Ghost in the Machine Q3 2025

October 6, 2025

ADM Exceeds 5M Regenerative Agriculture Acreage Gal

September 9, 2025