London Wheat Report

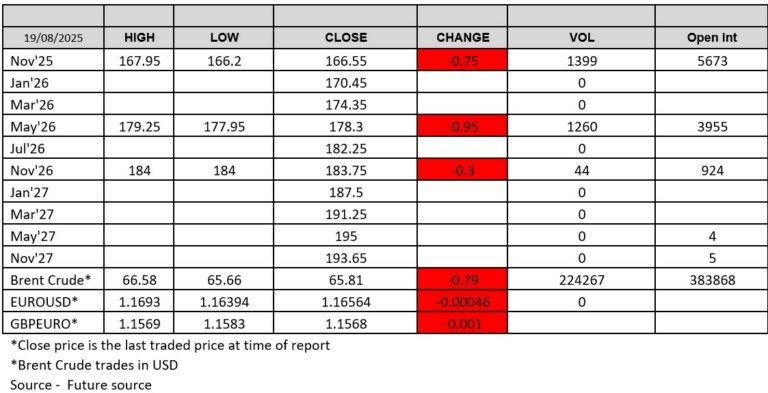

Another day of stronger volumes across London with over 1,300 lots going through the front month (Nov-25) contract and just under 1,300 lots going through the May-26 contract. These volumes appear to have originated mainly in the Nov25/May26 spread, which posted a cumulative volume of 1,213 lots settling at £-11.75. At these levels, it would appear that market participants were price takers, though, as both contracts continued their march further down into the red.

Both Matif and Chicago also spent most of the day languishing in the red, both pressured by an upward revision to Russia’s wheat crop forecast and the latest talks to end the war in Ukraine. In the US, corn eased as reports of strong yield projections from a US Midwest field tour maintained supply pressure. Yesterday, Russia’s IKAR consultancy reportedly raised its 2025 wheat crop forecast to 85.5 mmt from 84.5 mmt, further supporting expectations that the world’s biggest exporter is set for a large harvest despite a less sure start.

In other news, a Chinese-controlled trade house has booked a cargo of about 50,000 metric tonnes of new-crop Australian canola just days after Beijing imposed temporary levies on top supplier Canada. This marks China’s first import from Australia since 2020, when Australia, the world’s second-largest canola exporter, was locked out of the Chinese market. This was reportedly over issues with phytosanitary restrictions aimed at preventing the spread of fungal plant disease.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Ryan Easterbrook, Aaron Stockley-Isted and Jamie Kirkwood

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2025 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

The Ghost in the Machine Q3 2025

October 6, 2025

ADM Exceeds 5M Regenerative Agriculture Acreage Gal

September 9, 2025